are delinquent property taxes public record

Public Act 123 of 1999 shortens the amount of time property owners have to pay their delinquent taxes before losing their property. For Reno County such sales usually occur in the fall of each year.

Delinquent Tax Deadline Looms For 45k Property Owners In Cook County Chicago News Wttw

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000.

. Preparation and distribution of all property tax and sewer rent bills as well as local assessment bills including sidewalks demolitions etc and the maintenance of all associated. Real Property Parcel Search. Welcome to Erie County NY.

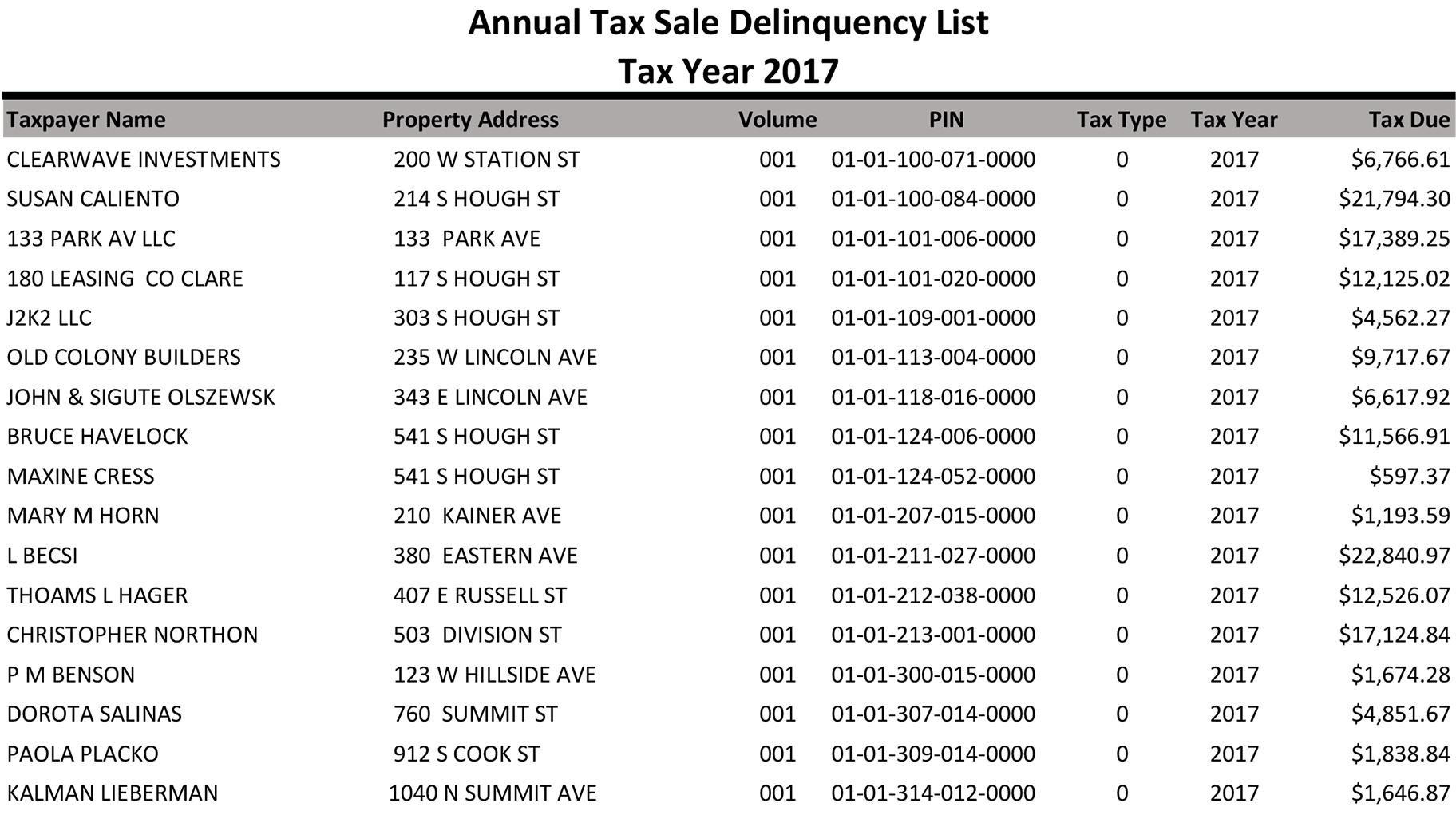

When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption. Finds and notifies taxpayers of taxes owed. To appear on this list the taxpayer must.

Please check your delinquent. Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. If the property owner fails to pay the delinquent taxes within two years from the date of delinquency the tax certificate holder may file a Tax Deed Application TDA per Florida.

803 785-8345 Real Estate Taxes. Real Property Tax Services. Delinquent Tax Department Brett Finley Phone.

The Delinquent Tax office investigates and collects delinquent real property taxes penalties and levy costs. The Wayne County Treasurers Office is responsible for collecting delinquent taxes on Real Property located within Wayne County. They are then known as a.

For your convenience you may mail payments to Larimer County Treasurer Public Trustee PO. Director of Real Property Services. To download the full.

Seizes property for non-payment in. Location We are located on the first floor of the Philo J. Property taxes not paid to the.

Delinquent tax records are handled differently by state. If left unpaid the. Failure to redeem the property within this time period will result in tax foreclosure and the sale of the property at auction.

830 AM to 430 PM EST. Deadlines for Property Taxes. Click here pdf for details and bidding guidelines.

Marlboro Street Bennettsville SC 29512 Click here pdf for Marlboro County Outline for Delinquent 2022 Taxes. Property Delinquent Property Tax At the close of business on April 15th the tax bills are transferred from the sheriffs office to the county clerks office. A system designed to help recoup property taxes from delinquent home and business owners is being used instead by hedge funds private equity firms and other investors to turn profits a.

All payments received may not be shown as of this date. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners. When property taxes go unpaid or are delinquent for a period of time this is recorded by the tax assessor or tax collector.

Brooks Building 59 Park Avenue Lockport NY 14094. Box 2336 Fort Collins CO 80522 or drop it off in our secure 24-hour drop. Thats the key to this real.

Additional delinquencies may exist for this property if parcels have been voided as part of a parcel reconfiguration such as a parcel division subdivision or consolidation. Have more than 25000 in total liabilities and Have not paid their taxes for at least 6 months from the day their taxes were assessed For questions. Its public record too.

Beaufort County Treasurer Begins Delinquent Property Postings This Week

How To Find Tax Delinquent Properties In Your Area Rethority

Property Tax Liens Treasurer And Tax Collector

How To Find Tax Delinquent Properties Mashvisor

Real Estate Property Tax Jackson County Mo

2021 Delinquent Tax Lists Westmoreland County

Office Of The State Tax Sale Ombudsman

Property Tax Collection Deschutes County Oregon

Tax Lien Certificates Vs Tax Deeds What S The Difference Proplogix

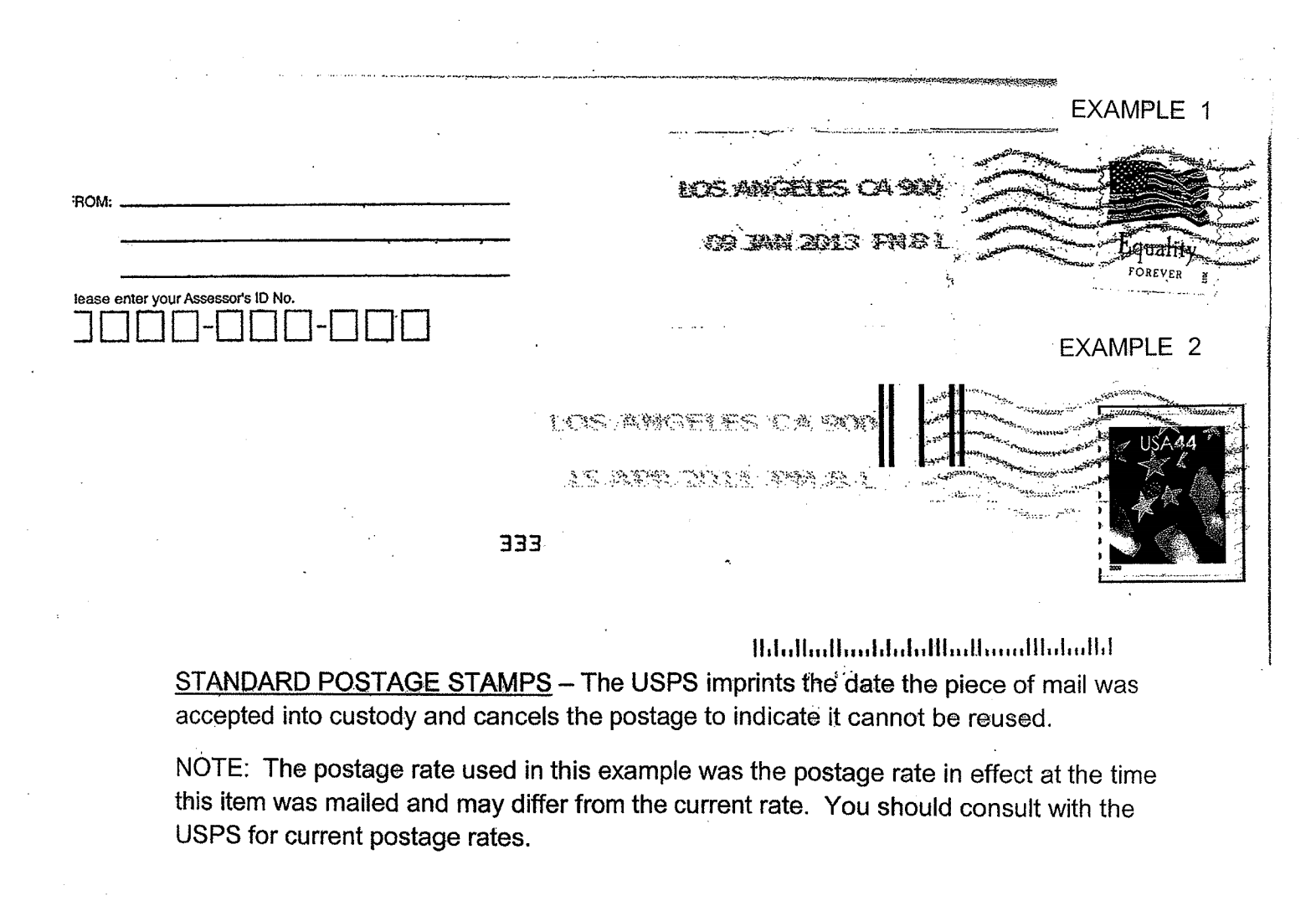

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Orange County Tax Administration Orange County Nc

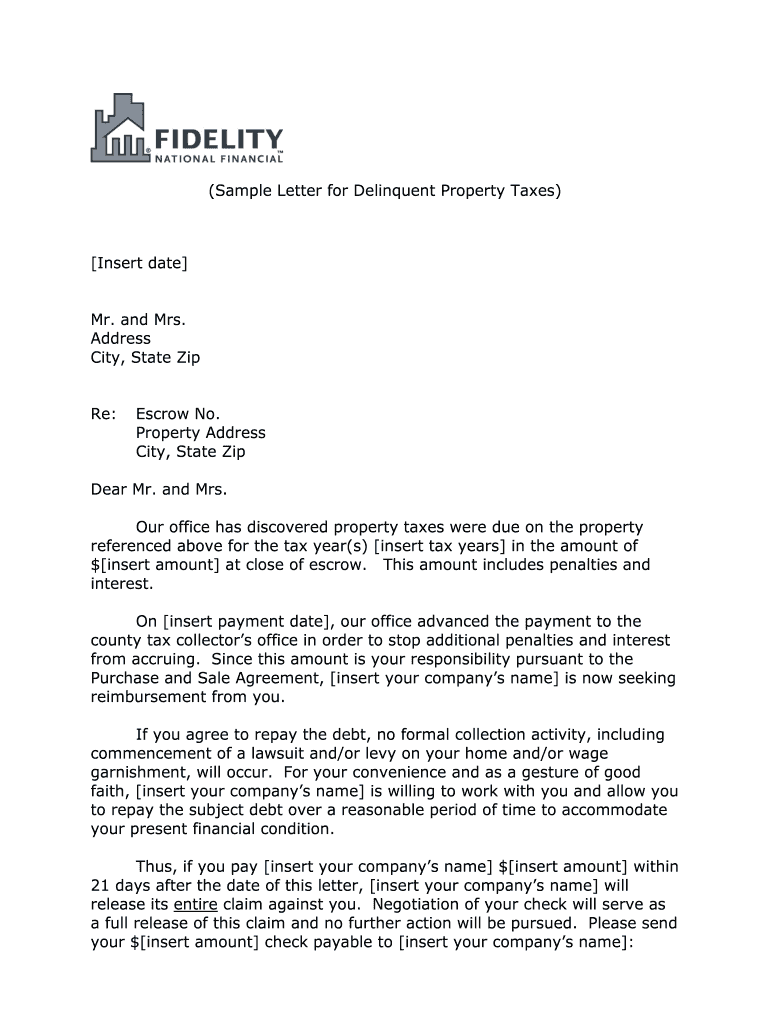

Delinquent Property Tax Letter Samples Fill Online Printable Fillable Blank Pdffiller

Tax Information City Of Katy Tx

Property Tax Payments Outagamie County Wi

Real Property Tax Howard County

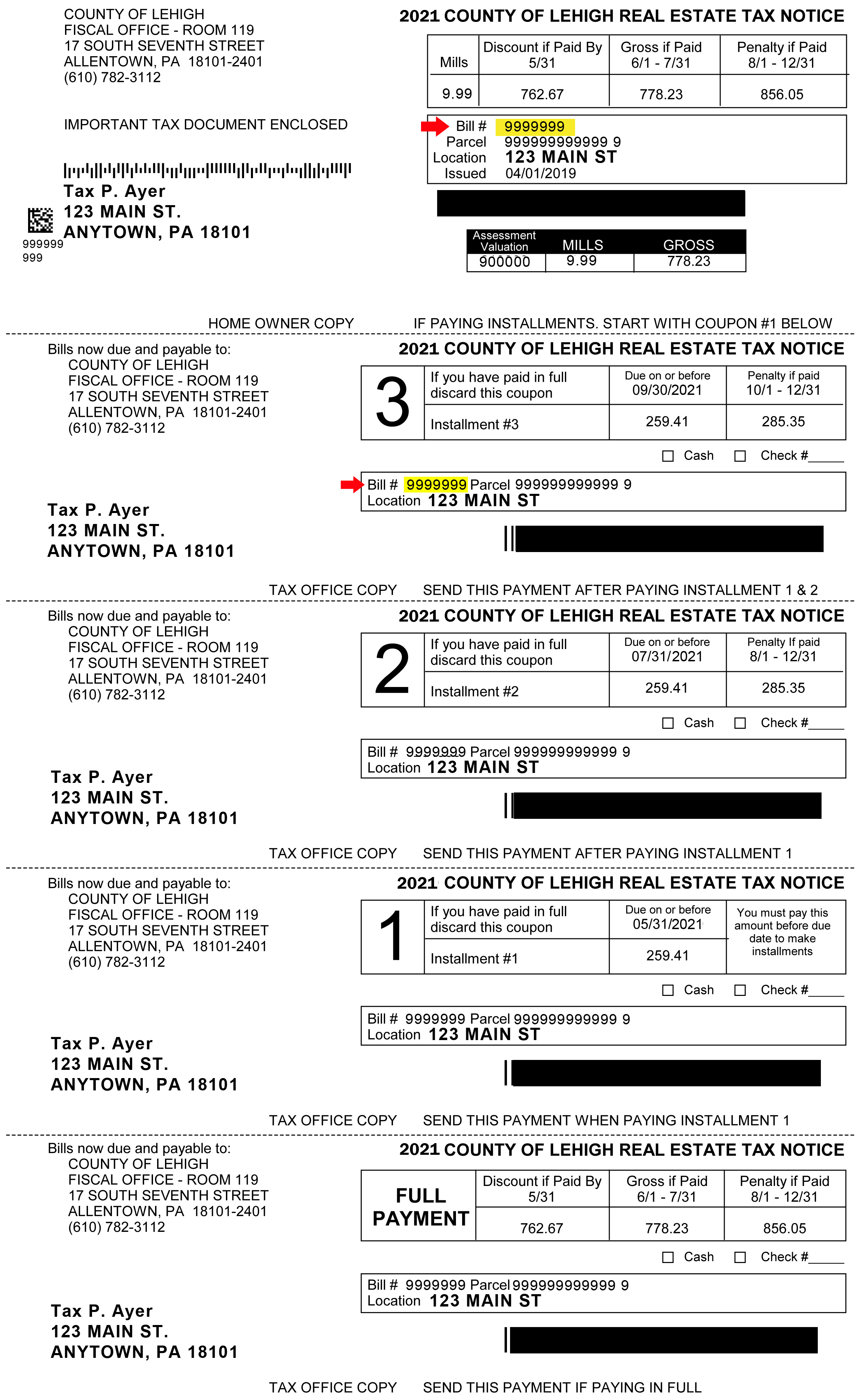

Property Tax Prorations Case Escrow